The side hustle concept is nothing new. The neologism to represent supplemental income was once referred to as moonlighting or simply a second job until the Urban Dictionary got its hands on it. The opportunities to make money to supplement what people earn from their careers however, have changed. Young Americans (18-35) in particular are leveraging technology to make extra cash by becoming digital content creators and the like. Many of these opportunities can be empowering. Some, are not. One area that has gained attention since the federal ban was lifted on the activity in 2018, is the concept of the sports betting side hustle. A large number of young men assume that they can make money on gambling because they have an above average understanding of sports. In reality, this manner of thinking leads them down a dangerous road. If you’re considering sports betting to supplement your income, please read ahead.

4 Big Reasons to Abandon Your Plan to Make Sports Betting a Side Hustle

The House (Sportsbook) ALWAYS Wins

You’ve heard it before. The house (or sportsbook in this case) always wins. But is it true? Research consistently shows that only 13.5% of bettors make it out with a profit, and that number typically declines the longer they play.

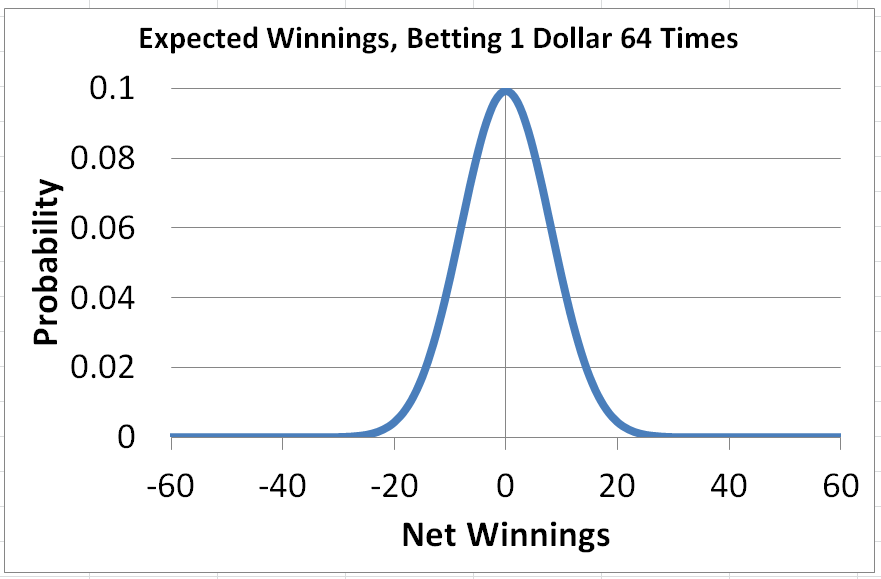

The Gambler’s Ruin formula confirms this. Let’s say that your sports betting odds are always 50/50 (EVEN) and you have a “power of 2” bankroll (what you can afford to lose). In this case your chance of going broke is exactly equivalent to your bankroll. If you have a 500 bankroll, you will go broke 1 in 500 times. If you have a 1000 bankroll, you will go broke 1 in 1000 series of bets. Consequently, anyone in it for the long haul will bottom out. In the chart below (view source) we analyze a bettor with a $63 bankroll who wagers $1 a total of 64 times, keeping their wager to $1 regardless if they won or lost. Their probability curve plays out like this:

Source: Gambler’s Ruin | Fairly Nerdy

Of course, sports betting odds are rarely as good as a 50/50 flipping of a coin. As soon as you factor in point spreads and parlays the probability of winning falls exponentially. And the probability of sustaining winnings? We’ll leave it to you to finish the math.

Side Hustles Aren’t Supposed to Create DEBT

Given that you’re going to lose astronomically more often than winning, there is ultimately one end for anyone who plans to make sports betting a longterm side hustle – debt.

Last summer, Men’s Health produced a survey of 3,800 American men about their involvement in sports betting. Below are some pretty startling statistics regarding sports betting debt that aspiring side hustlers need to take to heart:

Nearly 1 in 5 allot a quarter of their paycheck to sports betting

20% are in or have been in debt from sports betting

More than 50% are willing to wager $10K at a chance to win $1 million

The average debt of a male problem gambler is $55,000 and $90,000

You may assume that it’s “poor suckers” who don’t know how to make or manage money that get themselves in debt from sports betting, but as it turns out, the majority of guys in debt from sports betting have day jobs that pay between $100K and $150K per their year. These aren’t people who aren’t used to money management.

The odds of getting in debt are higher when sports betting. That flat out defeats the purpose of the side hustle concept.

Complicates Matters with the IRS

The Gambling Insider reported that 62% of Americans don’t know how to report gambling winnings. Internal Revenue Service (IRS) has made it explicitly clear that online sports betting winnings are considered income and are fully taxable. You are therefore required to report this income on your tax return. This includes money won from unregulated sportsbooks (accounts for 89% of sports betting in the USA) which is something the IRS is cracking down on. Whether sports betting personally or professionally as a side gig, you’re in for a hassle when the Tax Man comes knocking:

“A side bet with a friend and even wagering with an illegal outlet is treated as income by the IRS. You must include the full amount of your gambling winnings as income on Schedule 1, Form 1040 if you’re gambling for fun. And yes, anything you won from fantasy sports leagues are gambling winnings, according to the IRS.”

Bloomberg: How Even Casual Sports Bets Complicate Federal Taxes

Are you prepared to report every single penny won on your multiple sports betting accounts?

Greater Odds of Developing Gambling Disorder

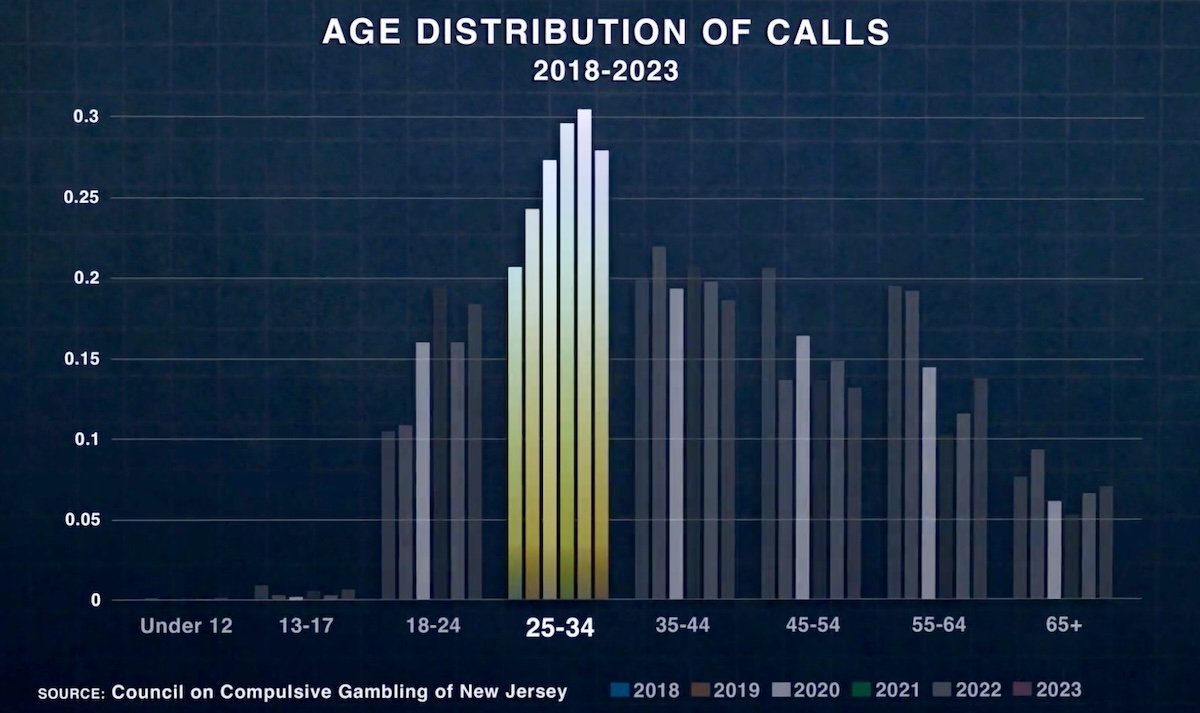

Forbes reports that young men are more likely than women to take on a professional side hustle, which aligns with who the primary sports betting market is comprised of. It’s critical to note that young men are among the most vulnerable to problem gambling. Those who have day jobs in certain vocations such as the military and athletics are even more vulnerable. The chart below shows how problem gambling helpline calls from this (your) demographic have grown since the legalization of sports betting in 2018.

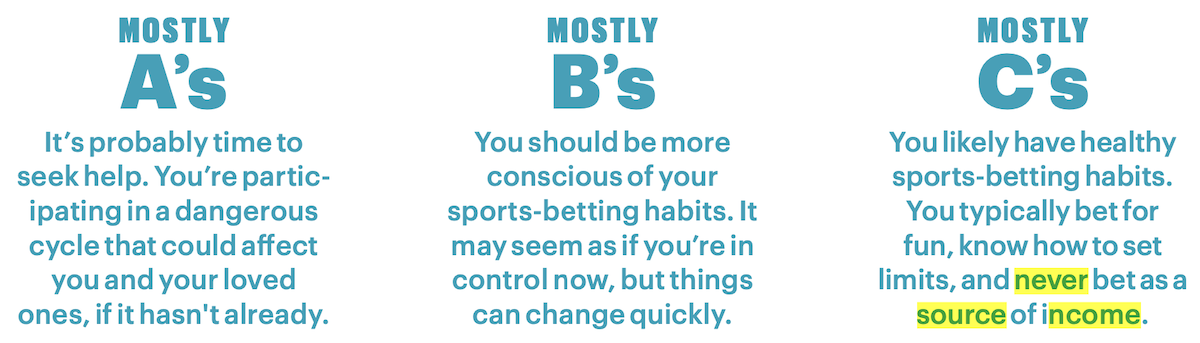

As a part of the Men’s Health nationwide survey referenced above, they created a quiz with problem gambling experts Marc Lekowitz, ICGCII, and Timothy Fong, M.D. Respondents were categorized as A’s, B’s and C’s based upon the multiple choice answers they provided. Those who didn’t consider sports betting as a means of income were least likely to have a problem with sports betting.

The mere fact that you’re considering sports betting as a source of income indicates that you may land in a concerning category. It’s time to abandon any plans that you have for sports betting as a side hustle.

Can’t Stop Sports Betting?

CALL +1 (877) 426-4258

OR